Shipping and Tax Integration

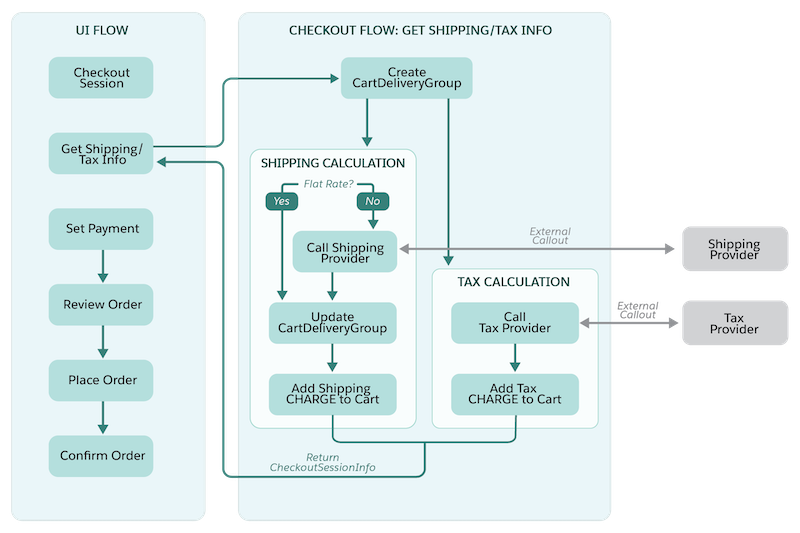

A single API call fetches both shipping and tax costs for cart items in B2B and D2C stores.

In the Winter ‘24 release, we introduced Commerce extensions for pricing, inventory, shipping, taxes, and other services. While the checkout integrations framework is still supported, we recommend extensions over integrations because they offer more targeted customizations for your B2B or B2C store. Plus, they’re available for more Commerce domains. See Get Started With Salesforce Commerce Extensions.

Because shipping and tax providers require the same inputs to make their respective calculations, a single API call fetches both shipping and tax costs for cart items.

An asynchronous shipping cost and tax API call to service providers is triggered when a shopper enters a shipping address.

Here’s the structure of RetrieveDeliveryMethod, the triggering shipping and tax calculation API call.

Here’s a sample DeliveryGroupRepresentation.

A reference shipping integration package supports both B2B Commerce and D2C Commerce implementations. You can use it as a template to create your own shipping calculation package.

Clone or download the Shipping Reference Integration Package package.

A reference tax integration package supports both B2B Commerce and D2C Commerce and implementations. You can use it as a template to create your own tax calculation package.

Clone or download the Tax Reference Integration Package package.